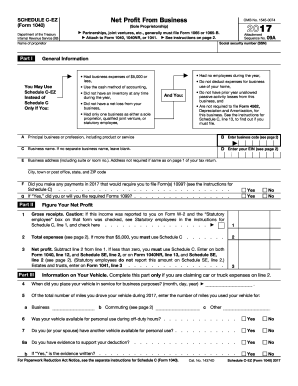

IRS 1040 - Schedule C-EZ 2018-2026 free printable template

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

How to fill out IRS 1040 - Schedule C-EZ

Latest updates to IRS 1040 - Schedule C-EZ

All You Need to Know About IRS 1040 - Schedule C-EZ

What is IRS 1040 - Schedule C-EZ?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule C-EZ

What should I do if I notice an error after submitting my IRS 1040 - Schedule C-EZ?

If you discover an error in your IRS 1040 - Schedule C-EZ post-filing, you should file an amended return using Form 1040-X. Ensure you provide clear explanations for the changes and submit the form according to IRS guidelines, including any necessary documentation to support your changes.

How can I track the status of my IRS 1040 - Schedule C-EZ filing?

You can track the status of your IRS 1040 - Schedule C-EZ submission online through the IRS 'Where's My Refund?' tool if you filed a refund request. For e-filers, check for any rejection codes you may have received and follow guidance on resolving them to ensure your form is processed correctly.

What should I do if my e-filing of the IRS 1040 - Schedule C-EZ was rejected?

If your e-filing of the IRS 1040 - Schedule C-EZ is rejected, check for the specific rejection code provided by the IRS. Address the issue by correcting any errors and resubmitting your form, ensuring that all provided information is accurate and complete to avoid further rejections.

Are there any specific requirements for using electronic signatures on my IRS 1040 - Schedule C-EZ?

Yes, electronic signatures are acceptable for your IRS 1040 - Schedule C-EZ when filed electronically through IRS-approved software. Make sure to follow the software's guidelines for electronic signatures to ensure the validity of your submission.

What happens if I receive an IRS notice or audit regarding my 1040 - Schedule C-EZ?

If you receive an IRS notice or audit related to your IRS 1040 - Schedule C-EZ, it is crucial to respond promptly. Gather all relevant documentation and details related to the notice, and consider consulting a tax professional for assistance in preparing your response and mitigating any issues raised.

See what our users say